Price of Hard Drives

This post is a short story about a recent observation: the surprising price of hard drives.

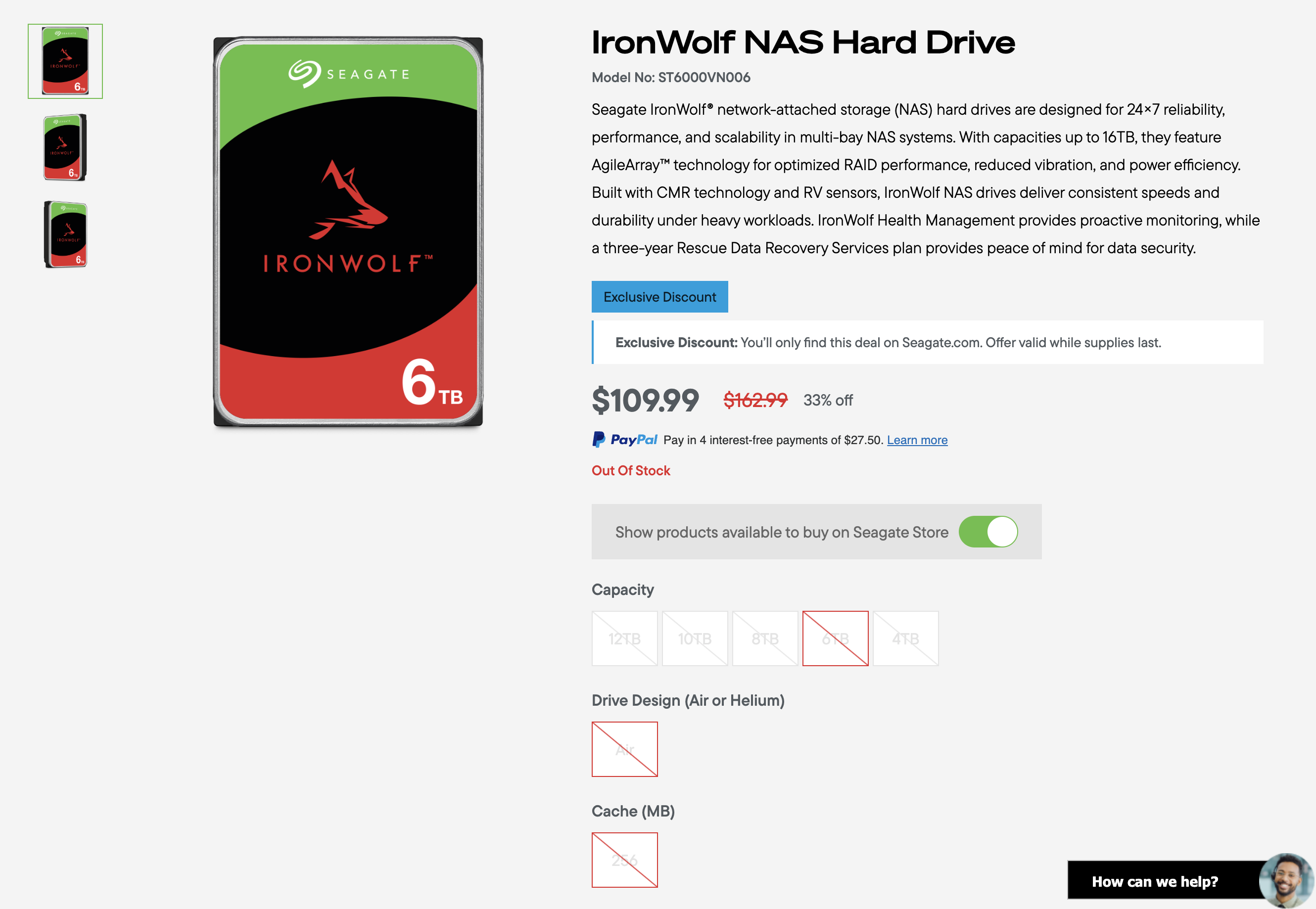

I hadn’t been following hard-drive prices closely, but I decided to build a home server this past November (11/2025). When I went to buy NAS drives, I was surprised to find that the usual rules of thumb for price-per-terabyte no longer applied, and even more surprised by how limited the purchase options were. In fact, Seagate’s standard consumer-grade server drive was completely sold out on their website.

I’m writing this because I used to assume that by the time I noticed something, the market had already priced it in. Over time I’ve realized that this isn’t always true, for example, with NVIDIA. So I thought I’d write my thoughts down while they’re still a bit fresh.

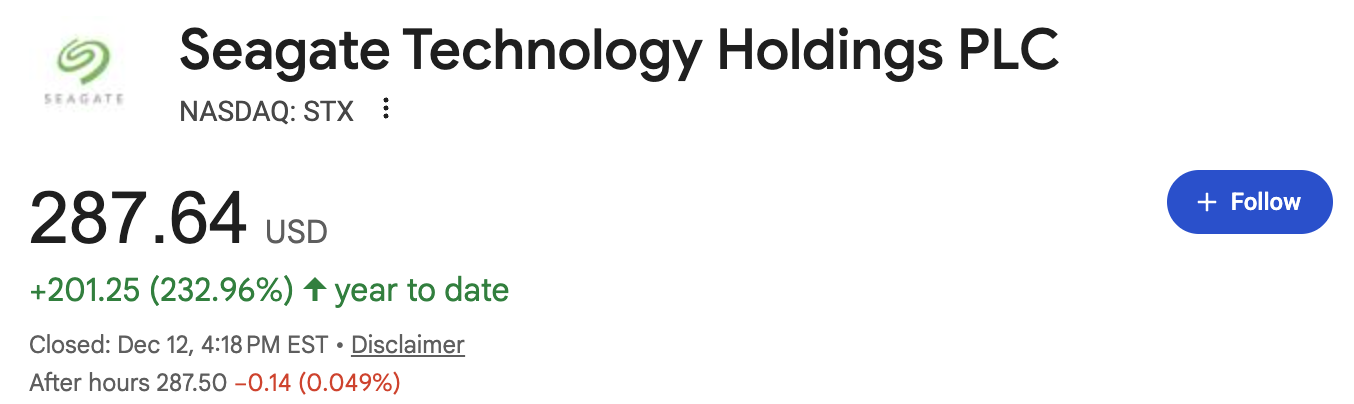

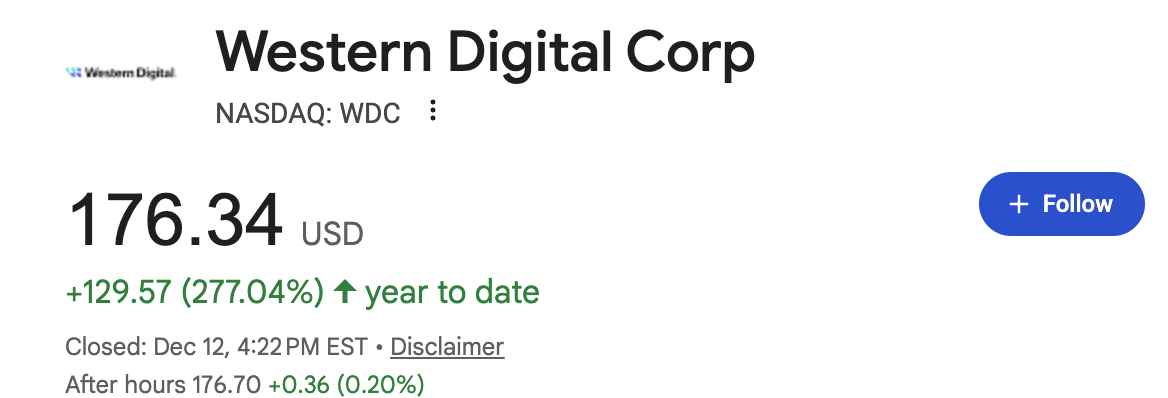

While the market is certainly aware of rising storage demand, and Seagate stock increased 232% in 2025 and Western Digital increased 277% in 2025, I’m still surprised that this topic hasn’t received more attention. If we are living through a tech bubble, it feels like the spotlight has remained on GPUs, with far less discussion of the massive storage requirements needed to run AI at scale.

There is enormous demand for hard drives right now, and I don’t see that changing anytime soon. A few reasons:

- The amount of data generated by models is immense

- Tools like google Photos increase accesibility of data

- That as models get better, there is only more focus on retaining data that might be later mined

All that to say, I think investing in hard drive manufactures might be a good idea. Of course, there are all the standard disclaimers, but I thought I’d write my thoughts.

I do not think I was early to this, but thoght I might comment on it 🙂

Current Data

Below are the current changes in the values of stocks since this post was written

Thanks for reading,

Stephen